Investment Bazaar app for iPhone and iPad

Developer: Investment Bazaar

First release : 21 Dec 2017

App size: 89.29 Mb

Investment Bazaar is a free online platform developed by iBazaar Initiatives Pvt. Ltd. for the clients to save, invest and grow.

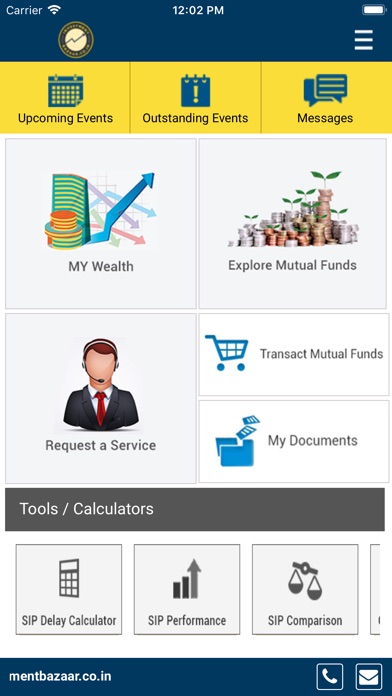

The App allows the client to make online transactions for purchase, redemption, online SIP, wealth management etc.

It provides clients access to their investment portfolio anytime, anywhere.

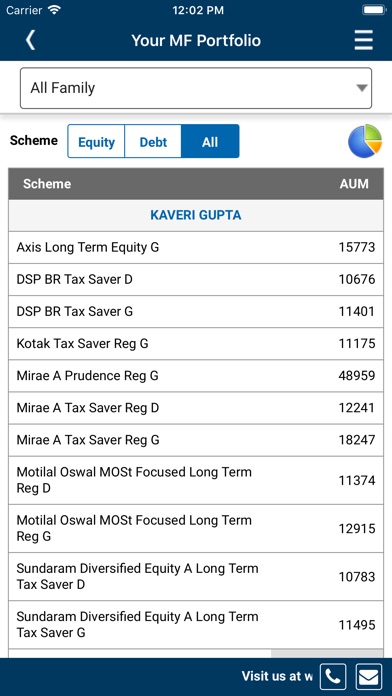

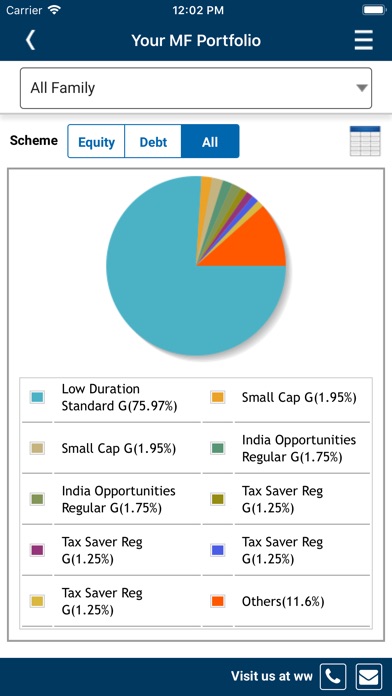

The App provides a consolidated view of the portfolio and gives access to:

- Dashboard: A snapshot of investment portfolio

- Performance: Summary of portfolio performance vs benchmark in different time periods

- Holdings: Detailed holdings with returns

- Other reports: Transactions, Corporate Actions and Realised Gain/loss; all just a few clicks away

FAQs:

Q. How is Investment Bazaar better than my savings account?

A. Normal saving account with banks give 4% interest, Investment Bazaar offers liquid funds which deliver between 6-7% while still being fairly secure and instantly available at no charges.

Q. Are there any Setup/Subscription/Transaction charges?

A. No. There are no Setup/Subscription/Transaction charges that you need to incur. However, there might be an exit load clause with some of the funds, if you withdraw too quickly

Q. Is my money safe?

A. Yes, absolutely! Investment Bazaar is a SEBI registered mutual fund distributor (ARN-131422). All your transfers are directly made to the underlying mutual funds and no money hits Investment Bazaars accounts. Investment Bazaar offers strict bank grade security for your data using encryption and secure data practices. Being in a high-compliance business, your data and money are both highly protected.

Q. What is the minimum amount I can invest?

A. You can start saving at a minimum of ₹500. After that, you can save as low as ₹100 and see the power of small savings on your saving app. Effective SIP investment allows for better financial planning.

Q. What documents do I need to set up my Investment Bazaar account?

A. We aim to provide a PAPERLESS experience. Investment bazaar will check seamlessly whether you are already KYC certified, which is mandatory for you to be able to invest your funds. In case not, you need to register through our website.

Best Features that help you save money & earn more

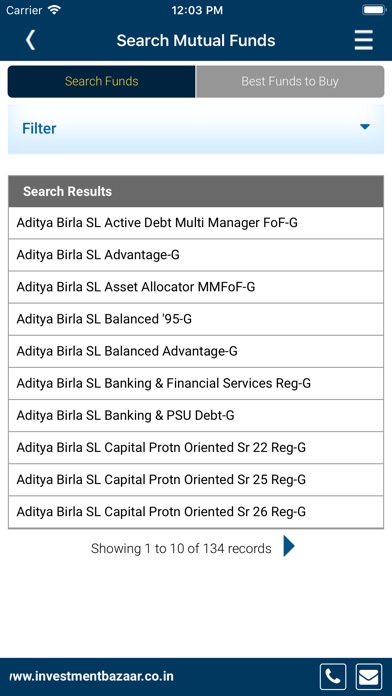

- Best mutual funds automatically recommended by platform.

- Simple monthly/SIP investment options

- Effective tax saving investment choices

- Financial planning simplified